A Discussion on Price Arbitrage and Liquidity in Art Investment

ArtRatio Interview with Francesco Gibbi CEO of LOT-ART | The Art Investment Platform

Carla Pohli, ArtRatio CMO, interviews Francesco Gibbi on LOT-ART as an innovative service hub for Art Investment, unfolding the reasons why investors should consider fine art and passion assets as an alternative asset class within effective strategies of portfolio diversification.

ArtRatio, the leading manufacturer of smart glass vitrines, is the top choice to conserve and display exceptional fine art and rare objects at museum's standards with lighting, temperature and humidity conditions tuned to the specific sensitivity of each object.

Fabergé Visionnaire I Flying Tourbillon Limited Edition

Carla: I understand you created Lot-Art with the intention of screening the global art market to identify the best investments. Could you share more about your concept and platform?

Francesco: Yes, of course. Lot-Art originated from the need for transparency and efficiency in the Art Market, and from there, we progressed naturally into Art as an investment asset class. We founded Lot-Art as The Art Investment Platform in Amsterdam in 2017 to finally provide a comprehensive view of the global art auction market, one specifically allowing for optimal investment portfolio diversification in fine art and passion assets, including contemporary & modern art, luxury watches, classic cars, fine wines, design and jewellery.

Our mission is to make art investment effective, time efficient and transparent, providing objective insight to allow for better informed decisions, with the final goal to facilitate the purchase of art-related assets as a valid portfolio diversification strategy from the volatile financial markets.

We’ve designed our user interface and developed advanced catalogue-search functions so as to offer the most advanced art and luxury browsing portal to effectively identify the best deals across the asset class. Ultimately, Lot-Art is about finding new value on the financial side. Fortunately, this can and does also lead to social spillover, with a positive impact on the artist and enlarging the pool of art investors, but our main purpose is investment advisement and reducing the risk of the portfolio as a whole.

Lot-Art aims to become the leading search engine and market place for fine art and passion assets, combining market analytics (statistical analysis on price trends, geographic price and volume clustering) with a dynamic collection management system targeting both private individuals and institutional investors.

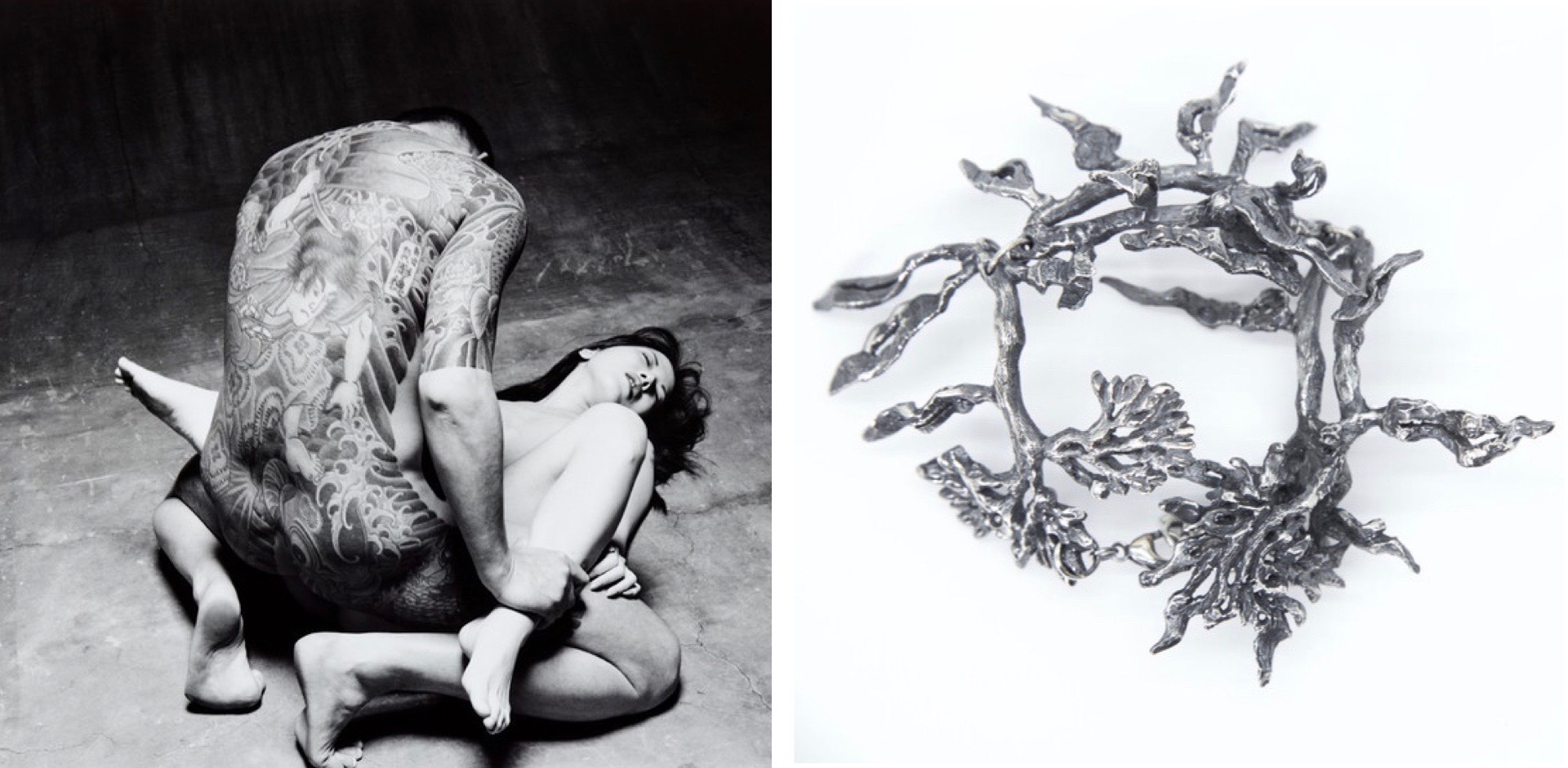

Left: Araki Nobuyoshi - Yakuza Copulating (from the series: Tokyo Comedy), 1998; Right: Sorrenti -Secret Garden, Bracelet – silver

Carla: Why is now such a good time for art or a passion-piece related investment?

Francesco: During and after the Covid19 pandemic, macroeconomic factors, such as inflation, unemployment, falling interest rates and forex volatility will inevitably affect financial markets. The low correlation of art & luxury assets with traditional investment instruments generates a portfolio’s diversification benefits, especially during times of economic uncertainty. Because it is combining the opportunity of a financial return with the aesthetic pleasure and physical ownership of a unique masterpiece, the art market is probably the most satisfying form of investment. Buying a piece of art is therefore a great choice for any investor looking for effective opportunities of portfolio diversification.

Art Investment isn’t an “out of the blue” phenomenon. It is however especially important now where we find ourselves in uncertain economic times. Fine art & passion assets are a way to effectively diversify any investment portfolio, reducing the financial risk as a whole. This is why I would buy art. But I’m also seeking those people not aesthetically sensitive to art (although it of course does apply to these people), often not even interested in the piece itself, the history, the artist etc., but just wanting to effectively diversify their portfolios. Solid, tangible assets are what bring you through times of uncertainty, and that describes where we’re at now: recession, unemployment, FX volatility, mounting fear of a new financial crisis. The higher the uncertainty, and the longer it is, the higher the risk is. And in the meantime, what do you do with your money? How do you keep it safe? Even in difficult times, you can make money, you can still surf a big wave. With crisis always come investment opportunities.

Download The Art Investment Brochure and learn how Lot-Art can identify for you the best artworks which are also sound financial investments.

I do see the light after Q2 2021, which is when these assets can bring returns. History shows us that assets are always what takes you through uncertain times, through war, high inflation, currency depreciation etc. Every wave is up and down, which is what history teaches. Liquidity of the asset is crucial ( gold bars or diamonds, for example, are not as liquid as fine art). Unless you buy the index, but then you aren’t diversifying much from the financial markets.

Carla: Why is art such a good asset class for diversification?

Francesco: In a nutshell, some of the benefits of the asset class are opportunity, diversification and performance. Art is one of the oldest and largest asset classes in the world. Actually, Sotheby’s was the oldest company on the NYSE until recently. Deloitte estimates that there is $1.7T in total wealth held in art, growing to $2.6T by 2026. Investing in art provides diversification into an uncorrelated asset. A Citibank study published in December 2019 concluded that art has the lowest correlation to public equities (a correlation factor of just 0.13) of any of the ten major asset classes, and contemporary art outperformed the S&P by 66% from 1999 to 2019. I’m preaching portfolio diversification. Not just buying art per se. That’s the key. We find ourselves at the right moment with the platform that can help people.

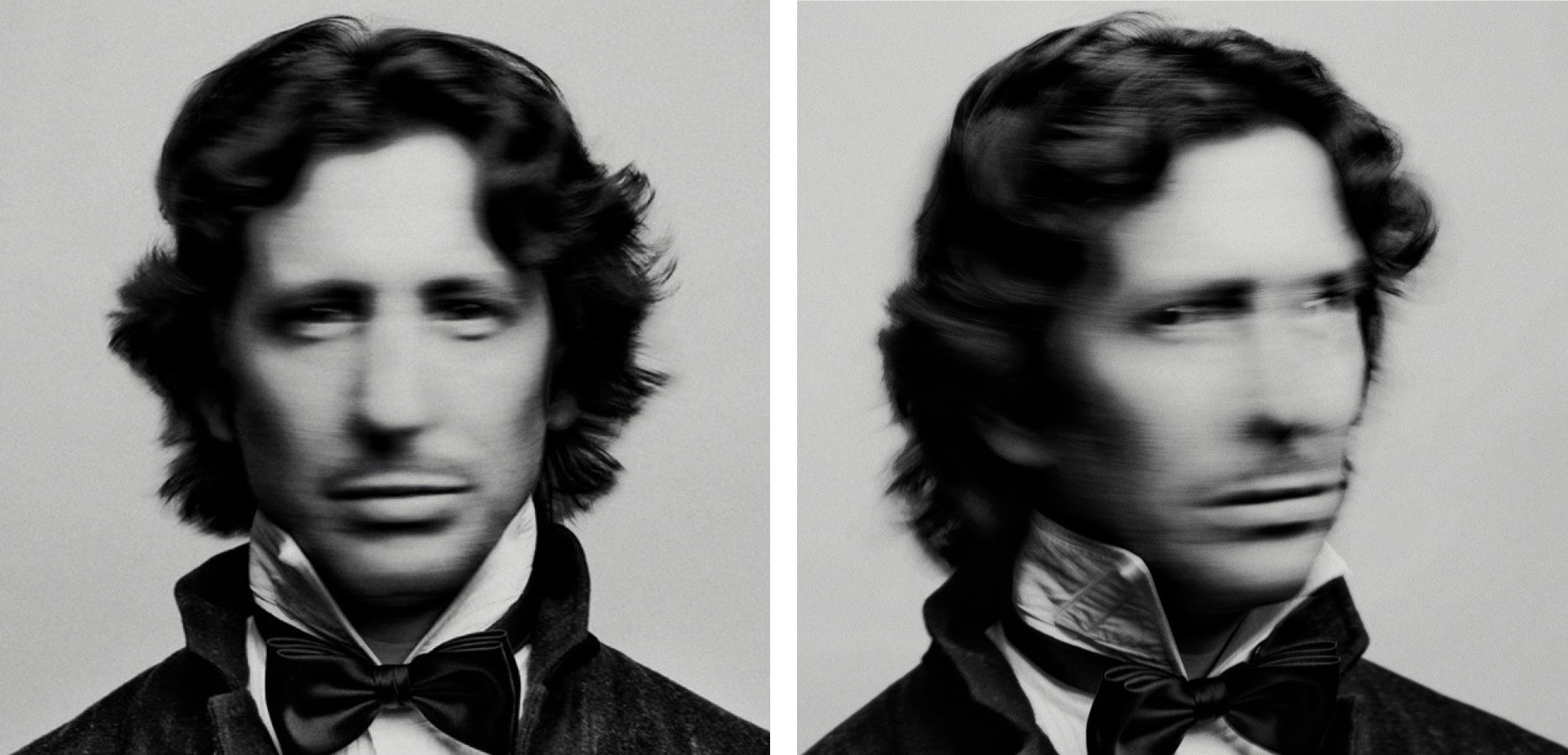

Francesco diptic portrait by photographer Bastiaan Woudt

At Lot-Art we have developed and are launching statistical analysis from October 2020, providing analytic market insights to assess the real-time value of a collection and make informed investment decisions in fine art and passion assets. LOT-ART members will have access to exclusive geo-price analytics exposing the best investment opportunities in the global art auction market.

Retirees often buy art in order to mitigate inheritance taxes. There are tax related savings found in several countries, for example, if you buy and hold the asset for at least 5 years, it is considered part of your collection and not an investment, hence no capital gains tax is applied.

The Bottom Line is that buying art for diversification is always a good idea. You can buy for different reasons, such as capital conservation, income generation, or for hedging currency volatility and inflation.

Left: Inta Nahapetjan - Enigma; Right: Inta Nahapetjan - Enigma SoulQuest I

Carla: Where do you start your evaluations in order to identify a piece for investment purposes?

Francesco: Art allows for many broad and different strategies: When you have your strategy defined, you go for different art forms for different reasons. Emerging contemporary art is more for aesthetic and artistic pleasure than a form of investment. The opportunity of a high economic return in the long term is mitigated by uncertainty, lack of information and therefore a high investment risk. It’s like playing at the roulette, exciting but also an unreliable gamble; Wherever you have access to historical price and volume data, you can track the asset liquidity rate, drawing the price trend of an artist, the category and the field itself. When you narrow down what you’re looking for, the first thing you need to look at, before price, is the condition report, provenance, and authentication. Once these aspects are satisfying then it’s important to look at liquidity, involving price analysis, historical sales data, or identifying the trend of something similar if it’s a unique piece.

Why do you buy it? Either for capital conservation or with a purpose of return on investment. Me, I can buy something I like and decide to keep for 20 years, as to me it is a passion piece. In this instance, I’m happy with just knowing I got it at the lowest price, through an arbitrage window in price or knowledge, and I’m happy with that because I have the certainty to have made a good deal and optimised my budget.

Left: Katerina Belkina - Circus; Right: Katerina Belkina - For Modigliani

Carla: Should art investment always be viewed as a long-term hold, or are there opportunities for short-term speculative trading?

Francesco: The purpose of art investment can be conservative, i.e. a long term form of saving without being speculative, like a saving account in hard currency, with the main purpose of protecting your capital from high inflation, currency volatility, and capital gain tax.

Short term speculation, instead, usually requires the resale of the asset within one or two years. To do so we leverage on geographical arbitrage and information asymmetries. A piece can be priced below value for many reasons, such as being poorly valued by the seller, a lack of specific expertise of the auction house, less popularity of the artist / brand in the market of reference.

Once you know you have a margin right before purchase, you’re set. We always talk about portfolio diversification based on an 80/20 capital ratio, depending of course on your risk profile and investment needs.

For more information on how to invest in art as an asset class visit: www.lot-art.com/art-investment-advisory

Other interesting articles

|

Thu Apr 25 2024

Art and Antiques at De Zwaan, AmsterdamDe Zwaan, Amsterdam presents the Spring Art and Antique Sale on April 30th - May 15th. The sale features fine art, Asian art, classic furniture, jewellery, watches & clocks, Tribal art and varia. Discover the Auction Highlights or browse the full catalogue here » SELECTED LOTS LEFT: Walasse Ting (1929-2010) - "Two women with parrots" Watercolour and Gouache, signed with... |

|

Wed Apr 24 2024

Masterly x Catawiki: "Homage" Collection | Exclusive DesignFor the installation at Salone del Mobile 2024, Catawiki and Masterly commissioned contemporary creators to reinterpret design icons. The auction "Homage" - A Tribute in Auction on April 28th is curated by Masterly founder, Nicole Uniquole, and includes the world-famous Eames Lounge Chair reimagined by Stefan Scholten. An auction inspired by the installation at Salone... |

|

Tue Apr 23 2024

A Selection of Jewelry at Casa d'Aste Guidoriccio, ItalyCasa d'Aste Guidoriccio, Italy presents the Auction: "Jewels. A Selection of Jewelry and Precious from Private Collections" on April 30th. Discover the Auction Highlights or browse the full catalogues here » SELECTED LOTS LEFT: Platinum and Diamond Ring, Fabergé Victor Mayer Collection. Diamonds totalling 0.78 ct. Limited series 11/100. See Price Estimate... RIGHT: 750... |

|

Mon Apr 22 2024

Enchantment at Palazzo Fortuny: 'Selva' by Eva Jospin in VeniceLEFT: Photograph of the Mariano Fortuny Y Madrazo Museum; RIGHT: Wagnerian Cycle. Parsifal. The Flower Maidens, Mariano Fortuny y Madrazo, 1896 Mariano Fortuny y Madrazo, born in Granada in 1871, was a renowned Spanish artist celebrated for his innovative contributions in the realms of fashion, photography, and lighting design. Fortuny gained global fame for the... |