Join the Opportunity of a Financial Return with the Aesthetics of a Unique Masterpiece

The Winning Strategy

Leveraging on the platform's big data analytics, market expertise and international network, Lot-Art Investment Advisory (LAIA) will assist you with selecting, acquiring, valuating and selling fine art and luxury collectibles at the best price, to optimize your portfolio diversification strategy.

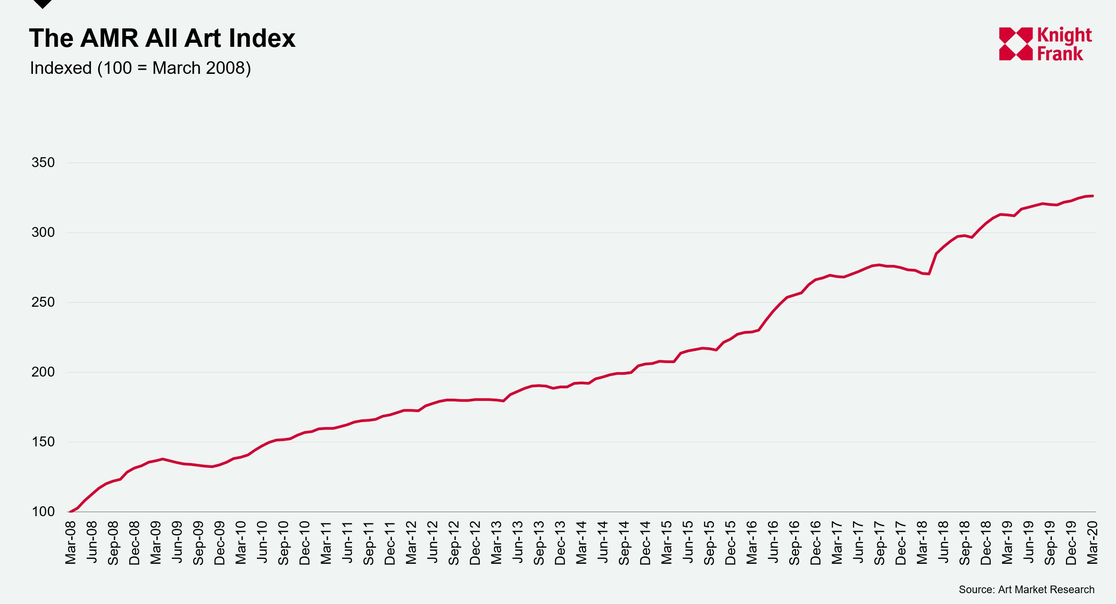

When high inflation and interest rate hikes inevitably affect financial markets, the low correlation of art-related assets with traditional investments generates high capital diversification benefits.

A Financial Approach to Art Collecting

Proposing an innovative financial approach to art collecting, LAIA selects the best investment deals, tailored to individual taste, budget, risk profile and financial objectives - capital conservation, or short tem speculative.

Exploiting geographical arbitrages and information asymmetries in the global art market, LAIA enables investors to secure quality assets which are also sound financial investments, offering a high degree of capital liquidity and opportunity of return.

Fine Art as an Alternative Investment

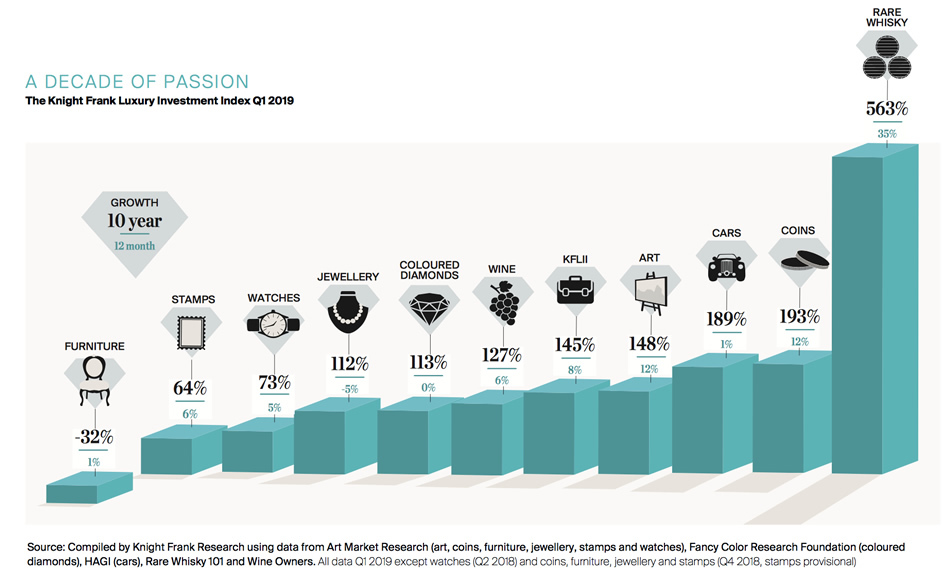

According to Knight Frank’s Luxury Investment Index, art was the best performing ‘assets of passion’, rising by 29% in 2022,

More rewarding than the standard financial instruments

- Aesthetic Pleasure (beauty & harmony of the colors, shapes, composition)

- Prestige of Ownership (artwork as non-fungible and unique asset)

- Cultural and Historical Value (age, heritage and provenience)

Capital risk diversification benefits

- Less sensitive to macroeconomic factors than stocks, bonds, funds (inflation, forex, interest rates)

- Low correlations with traditional investment instruments generate portfolio's diversification benefits

- Less volatile in economic value (when proper diversification strategies among art periods are followed)

- Capital protected from extreme economic events (currency deprecitation, high inflation, bankruptcy)

- Art can hold long-term multigenerational wealth (favorable inheritence tax regimes in many countries)

- Source of liquidity in hard currency (colletarelization for secured lending, international storage & resale)

- Geographical arbitrages and information asymmetries offer immediate opportunities of return on investment

Diversify your investment portfolio in fine art (contemporary to old masters) and passion assets (watches, classic cars, jewelry, wines).

Lot-Art can assess the liquidity of fine art and timepieces to identify best investment deals in the global auction market, optimizing the portfolio diversification strategy of private collectors and financial institutions who wish to invest in art-related assets with the highest potential return.

Explore now the Financial Side of Art & Luxury with LAIA: Fill in the inquiry form below and our team will be in touch without obligations.

Francesco Gibbi - Founder & CEO | LOT-ART